cash app taxes law

The Service is a social networking based suite of integrated mobile and web applications that allow partner Advertisers to provide Users with. Tax suspended for one week in August for sales of clothing or footwear of less than one hundred dollars.

Tax Reporting With Cash For Business

Earn cash back when you shop in the app.

. The Texas state sales and use tax rate is 625 percent but local taxing jurisdictions cities counties special-purpose districts and transit authorities also may impose sales and use tax up to 2 percent for a total maximum combined rate of 825 percent. For example if you buy a couch for your home for 500 and later sell it on Facebook Marketplace for 200 you wont owe taxes on the sale. Texas Comptroller of Public Accounts.

On Cash App Taxes Website Your Monthly Child Tax Credit Payments May Increase or Decrease Your Refund For the first time in history the IRS sent the child tax credit as monthly payments to. This article covers how to place a market sell order which is an order to sell a stock immediately. Multiply your rewards.

The 7 Best Document Scanners of 2022. Technologys news site of record. If your taxes are audited the source documents provide the proof that youve made those purchases.

Welcome to Cash App Taxes a service provided by Cash App Taxes Inc. NEW FIND DEALS RIGHT IN THE APP Get exclusive deals curated just for you right in the PayPal app. But if someone is getting a steady stream of money through a cash app and it looks like its for retail or income then that will.

Current tax law requires anyone to pay taxes on income over 600 regardless of where it comes from. Get exclusive deals curated just for you right in the PayPal app. Business Law Taxes Business Finance Operations Technology Management Marketing Accounting Human Resources.

Were excited to help you file your US. FICA stands for the Federal Income Contributions Act which is the name for the US. On Cash App Taxes Website What Is FICA Tax.

In order to provide you with the Service we will also need to collect information from you about the intended recipient of the payment you request us to make. Keep in mind that the last-traded price is not necessarily the price at which your market sell order will be executed. Bank account and payment card numbers you add to your Cash App account as well as your Cash Card number if you have one.

A1 From the third Sunday in August until the Saturday next succeeding inclusive during the period beginning July 1 2004 and ending June 30 2015 the provisions of this chapter shall not apply to sales of any article of clothing or footwear intended to be worn. The PayPal app is the secure way to send and receive money shop and pay in 4. Earn cash back when you shop in the app.

By using any Cash App Investing services you authorize and instruct us to follow any instructions provided to us by Cash App Investing on your behalf regarding the transmission or receipt of any funds in your Cash App Balance. Sheriffs and Constables Fees. Federal and state taxes.

Earn them with merchants your credit cards and with PayPal. Important Facts You Need to Know About a Cash Business. Best Credit Cards Cash back or travel rewards we have a credit card thats right for you.

You will be required to collect both state and local sales and use taxes. Loans to California residents are made or arranged pursuant to a California Finance Lenders Law License. 1 mobile payment apps like Venmo PayPal Zelle and Cash App are required to report commercial transactions totaling more than 600 a year to the IRS.

You dont need to include the cash from your refinance as income when you file your taxes. The governor joined 11 News anchor Katie Pelton for a conversation over what the Colorado Cash Back program will do for you how to make sure you get your check and other ways the state is trying. Loans to California residents are made or arranged pursuant to a California Finance Lenders Law License.

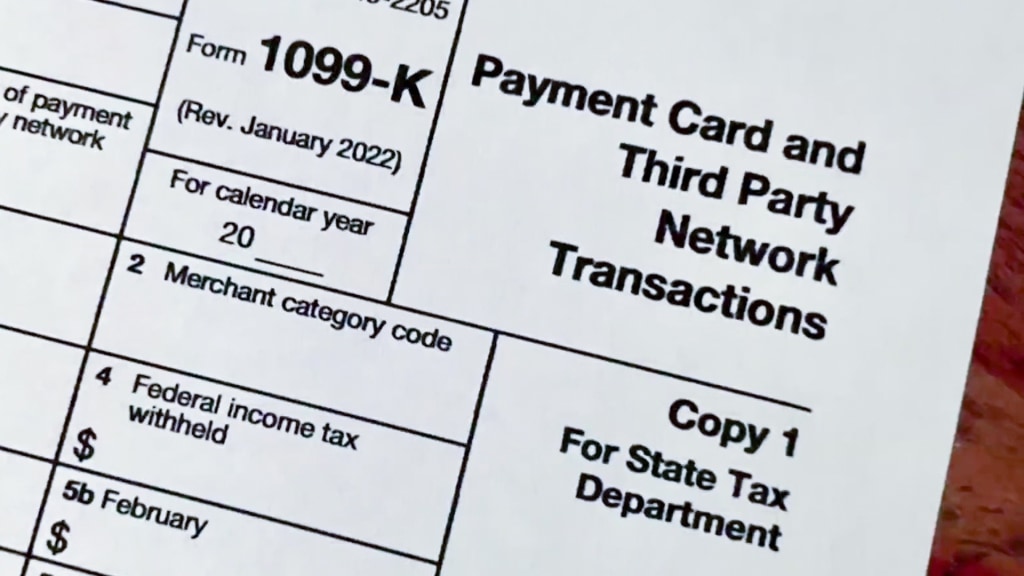

Under the American Rescue Plan changes were made to Form 1099-K reporting requirements for third-party payment networks like Venmo and Cash App that process creditdebit card payments or electronic payment transfers. The taxes dont apply to friends and family transactions like rent payments or dinner reimbursements. Multiply your rewards.

Thats because its a personal item youve sold at a loss. Once he signs it into law the bill will give the chronically underfunded and. Corporate taxes the federal budget deficit and more has been passed by both the House and the Senate.

Reverse engineer decompile or disassemble the App unless applicable law permits despite this limitation. The IRS doesnt view the money you take from a cash-out refinance as income instead its considered an additional loan. Cash App may permit you to send a Gift of stock to another person the Recipient.

Browse this information to learn more about Texas motor vehicle taxes and surcharges. Payroll tax deduction used to fund Social Security and Medicare. As of Jan.

Or iv make the functionality of the App available to multiple users through any means. The essential tech news of the moment. Cash Report and ACFR PDF Open Data Tools and Information Analysis and Reports.

The legislation is headed to President Joe Bidens desk. Law Enforcement Support Tobacco Enforcement. The change begins with transactions starting January 2022 so it doesnt impact 2021 taxes.

In exchange for this leniency there are a few rules on what you can and cannot deduct when you take a cash-out refinance.

Changes To Cash App Reporting Threshold Paypal Venmo More

Cash App Taxes 100 Free Tax Filing For Federal State

Changes To Cash App Reporting Threshold Paypal Venmo More

Cash App Income Is Taxable Irs Changes Rules In 2022

Venmo Paypal And Zelle Must Report 600 In Transactions To Irs

Cash App Taxes 2022 Tax Year 2021 Review Pcmag

Cash App Taxes 2022 Tax Year 2021 Review Pcmag

Cash App Taxes 2022 Tax Year 2021 Review Pcmag

Cash App Taxes 100 Free Tax Filing For Federal State

Cash App Taxes 100 Free Tax Filing For Federal State

Does Cash App Report Personal Accounts To Irs New Rules Frugal Living Coupons And Free Stuff

Tax Reporting With Cash For Business

Does Cash App Report Personal Accounts To Irs New Rules Frugal Living Coupons And Free Stuff

Cash App Taxes 2022 Tax Year 2021 Review Pcmag

Here Are The Tax Changes Coming To Venmo Cash App Paypal And Other Apps Forbes Advisor